Learning To Invest - Part 1

At work I am inundated with financial buzz words all the time, It is {code} vs equities, derivatives… Being a tech guy, I knew next to nothing about what was being discussed.

As days passed by and I settled down to engineer Minance’s tech, which also powers our new website(which will be up in a few weeks), mobile apps and web dashboard, my interest towards investing in stock markets grew and the curious cat inside me wanted to dive right in. I was excited. Why did I want to invest? Three reasons. One, learning about investing would help me manage my finances better; two, help me build better products for Minance, and three, save tax. All I needed now was someone to guide my sails.

I decided to go to the best source I knew, Anurag Bhatia.

Anurag is Minance’s CEO and a seasoned investor. He asked me to first identify what my investment goal was, essentially a self-evaluation. I’m financially stable, and with no major expenses coming up, hence I can invest for the long term. This let me build corpus while also saving tax on my income.

However as a Muslim, I have certain rules that I have to abide by, which include prohibitions against making money from interest based securities as well as forbidding investments in alcohol, gambling, and firearms.

Shari’ah compliant investing or Islamic Finance if you will.

Zaid: What is the difference between investment philosophy, and investment strategy ? What should I choose?

Anurag: Investment philosophy is a set of guiding principles that determine your decision making process. Investment strategy is the method you use to invest. In your case, your investment philosophy should be buying stocks in growth companies and holding them for 3–5 years. Your strategy should be building a portfolio of 15–20 growth stocks after researching them instead of going the mutual fund route.

Zaid: Which is better, yearly lump sum investments or monthly SIP’s?

Anurag: Empirical studies show that SIPs are always more profitable when the investment timeframe is more than 10 years.

Zaid: Do we have any Shari’ah compliant investment options in India?

Anurag: No. There has not been much push from RBI or SEBI to bring in Shari’ah compliant investments. There was some chatter from RBI to set up an Islamic Bank but that went nowhere. There’s a Shari’ah compliant mutual fund by TATA though.

We initially narrowed down my options to two choices:

- Equities for long term investment and

- ELSS (Equity Linked Saving Scheme) for tax savings.

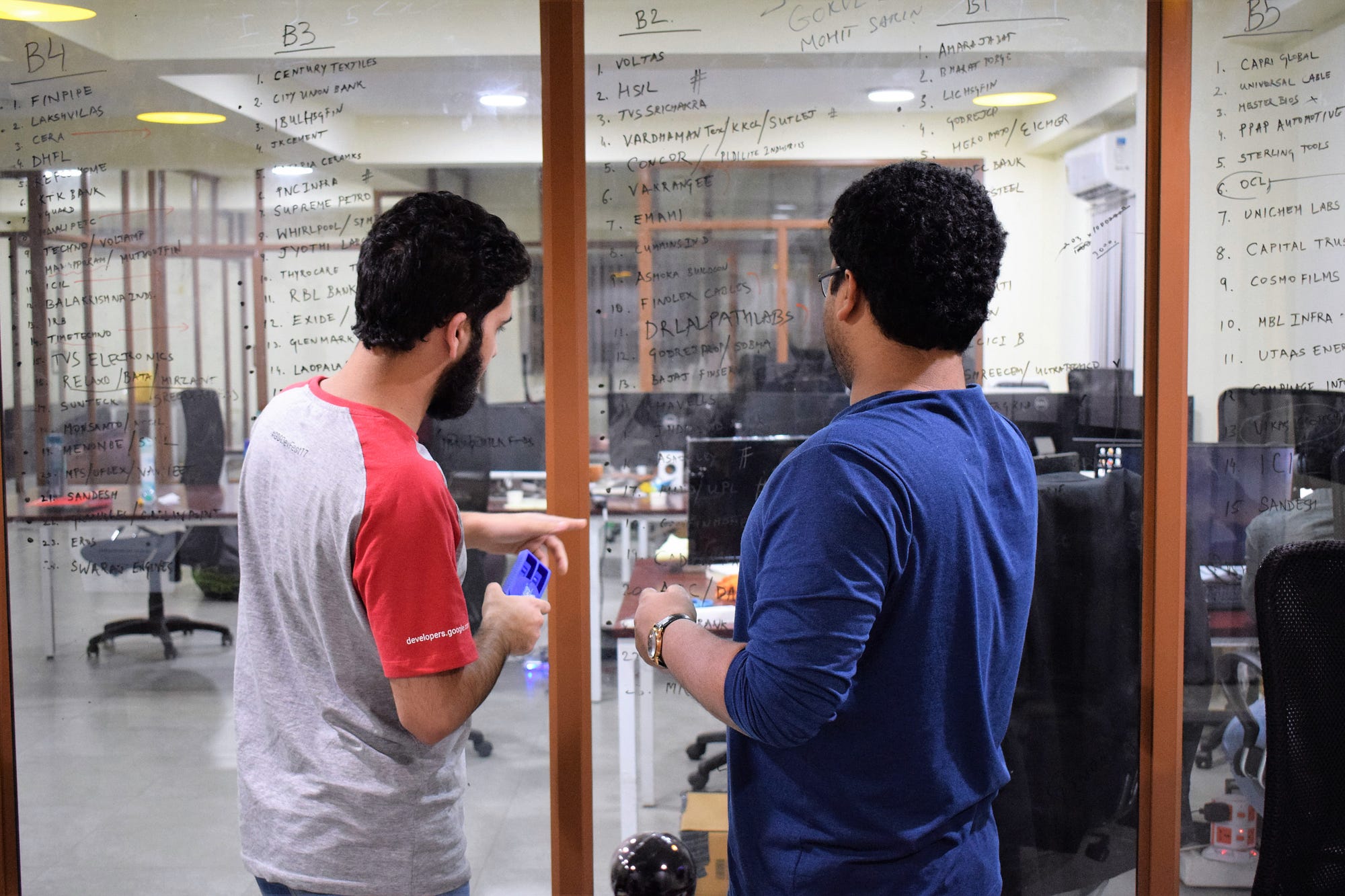

We did some quick research and came to know that a Sharia Compliant ELSS does not exist in India, so that went off the list and Anurag advised me to invest my capital in a curated list of stocks. After a ton of research, we shortlisted the following stocks to be included my portfolio.

- KEC International

- Finolex Cables

- Dr. Lal Path Labs

- Godrej Properties

- Vakrangee

- India Glycols

Now let’s go through each of the stocks we chose and dissect these companies.

KEC International is India’s second largest manufacturer of electric power transmission towers and one of the largest Power Transmission Engineering companies in the world and is part of the $4.0 billion RPG Group. It has a strong global footprint with improving margins from SAE Towers (gaining traction from Brazil) and Saudi JV. Soubhagya scheme will aid domestic order growth for T&D and Cables. Foray into Africa reduces the risk from few geographies. Railway track electrification and signalling is growing at 230% YoY adding top-line and diversification.

Finolex Cables is an Indian manufacturer of electrical and telecom cables and is a part of $510 million Finolex Group. JV with J-Power systems will gain traction in high power transmission (500Kv) along with Telecom cables showing growth. CFL/LED and Switches division has a CAGR of ~ 20%. High capex cycle will provide green-shoots. Decision of not selling leftover Copper rods to outsiders and focus on captive consumption gives head room for margins to grow while rising copper prices are a threat as raw material costs can squeeze margins.

Dr. Lal Path Labs is an international service provider of diagnostic and related healthcare tests with an annual revenue of $142 million. Focused on asset light (leasing) and a Hub -Spoke model have improved margins. Targeted expansion by developing reference labs in Lucknow and Kolkata have improved their geographical presence. With increase in health awareness, disposable incomes and literacy rates, households increasingly demand better healthcare facilities and quality of care. Also increasing prevalence of lifestyle diseases will add traction in the future.

Godrej Properties is an Indian real estate company with an annual revenue of $270 million. In its push for affordable housing Godrej Properties (GPL) has acquired a new group housing project in Sohna (new market entry). Despite sluggish residential demand in NCR over last 4 years, GPL has leveraged its strong brand name and product quality well, leading to strong sales in most of its ongoing NCR projects. In past 5 years, the company has been steadily ramping up its project portfolio in the NCR through JDA/JV/Development Management deals with local developers.This allows the local partner to handle various project approvals/clearances, while GPL focuses on leveraging its strong brand name and product quality to provide the necessary selling/marketing push. Consequently, most of GPL’s NCR projects have seen strong new sales and sold 80% plus inventory in its ongoing NCR projects. Importantly, the company recorded such strong performance despite overall NCR residential demand being sluggish in past 3–4 years.

Vakrangee is a technology solutions company, focusing on creating India’s largest network of last-mile retail points-of-sale, to potentially enable every Indian to seamlessly benefit from financial inclusion, social inclusion, Digital India, Skill Development, Employment, Government programmes and a wider access to basic goods and services. With an annual revenue of $6.1 million, they have no long term debt and are constantly expanding and increasing their penetration. Camany has been maintaining profit growth of over 50% in the last 5 years and has maintained a high 3 year ROCE of 30% .

India Glycols holds the distinction of being the only green petrochemical company of its kind. With an annual revenue of $386 million, it is one of the leading manufacturers of glycols, ethoxylates and PEGs, performance chemicals, glycol ethers and acetates, natural gums and potable alcohol. India Glycols is the first and only company in the world to have commercialized the production of ethylene oxide, its derivatives and glycols from renewable agricultural resources. The profit has doubled and margins have improved. Revenue is increasing .

In the next part of this series we will focus on the mathematics of building an efficient portfolio. Until then, Happy New Year!

…

This article was originally published at Wonkery, Like it? Read more Wonkery here.

Interested in Minance? See how we can help you with wealth management.

Share this article: